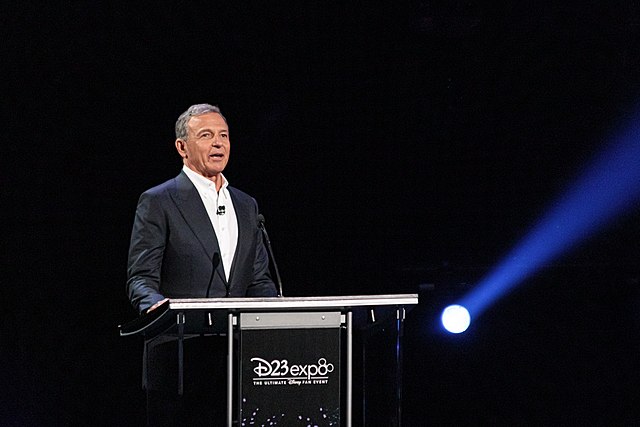

Disney+ posts first subscriber loss – what next for the House of Mouse?

Disney’s chief executive Bob Iger has announced plans to cut jobs and release some major sequels after its streaming service posted its first-ever loss in subscribers. Iger, who returned to Disney to in November last year, presented the company’s latest quarterly figures this week, and spoke of his desire to monetise some of the company’s biggest franchises. He said: I’m so pleased to announce that we have sequels in the works from our animation studios to some of our most popular franchises: Toy Story, Frozen and Zootopia. We’ll have more to share about this production soon, but this is a great example of how we’re leaning into our unrivalled brands and franchises.”

However, Iger’s enthusiasm came in stark contrast to the negative news from the House of Mouse. Disney+ has lost 2.4 million subscribers during the first quarter, bringing its total down to 161.8 million. In order to make the service profitable, Disney has already raised theme park costs, and Iger announced that around 7,000 jobs would now be cut. This amounts to around 3.6% of Disney’s global workforce, and it is hoped by Disney that this will save £4.5 billion. Iger said he did “not make this decision lightly”, but that it would “better position us to weather future disruption and global economic challenges”. The economic numbers were certainly mixed – Disney reported an 8% rise in sales to $23.5bn and an 11% rise in profit (to $1.3bn), but Disney+ lost $1.5bn in the same period.

The Disney+ boom was in large part linked to the pandemic, something that gave all streaming services a giant surge in subscribers, but that moment has now passed

The immediate question is why the streaming service should be struggling, and there are some easier answers. The Disney+ boom was in large part linked to the pandemic, something that gave all streaming services a giant surge in subscribers, but that moment has now passed. The concern at the moment is the cost-of-living crisis around the world, leading many people to cut back on luxuries and non-essentials – streaming services certainly fall within that description. Netflix has seen better-than-expected growth over the same period, and many believe that the new ad-supported (and thus, cheaper) price tier is responsible.

Iger’s reason for the losses was a simple one too – he attributed it entirely to Disney+ Hotstar, the Southeast Asian/Indian version of the streaming service, and a setback last year as it lost the streaming rights to the Indian Premier League cricket. After this news, Disney had lowered the growth projections for the service, and warned investors that there was likely to be a decline, though it was larger than forecast. Notably, there was a small rise to subscriber numbers in the US and Canada, which grew around 200,000 in the same period.

This reflects a growing lack of investor confidence

It’s true, though, that Disney is facing challenges at the moment – indeed, the poor financial performance of its theme parks, streaming service and recent films was one of the factors motivating the board of directors to bring Iger out of retirement (as well as his predecessor Bob Chapek falling into a political row with Florida governor Ron DeSantis, leading to Disney losing many of its tax benefits). Prior to these latest figures, Disney’s share price had declined almost 50% over the past two years, from an all-time high of $200 to just $110.71 last week – at points in the past year, this was below $90. This reflects a growing lack of investor confidence, and concerns that Disney’s strategy of buying IPs and absorbing them into its production is only strong if the end products attract attention.

Disney’s trajectory at the moment is downwards, and it remains to be seen whether Iger’s intentions to restructure and restore the company will bear fruit

The two biggest IPs Disney acquired where Marvel and Star Wars, both of which have seen major downturns in their popularity and, thus, financial performances. Look at Phase Four – Black Widow, Shang-Chi, Eternals all failed to break even, and the only real hit critically and commercially was Spider-Man: No Way Home, a film made by Sony. Marvel has been a touchstone of the Disney+ service, but the low-quality series have significantly diluted interest in the brand. Its own original films aren’t faring much better, with Turning Red, Strange World and Lightyear all losing massive amounts of money for the company. There are successes, but they aren’t frequent enough to counteract the losses.

Disney’s trajectory at the moment is downwards, and it remains to be seen whether Iger’s intentions to restructure and restore the company will bear fruit. A much-publicised battle by activist investor Nelson Peltz to ‘restore the magic’ is now over after these announcements, suggesting a degree of confidence that Disney can reshape what it offers to appeal to its audience once again. If not, it’ll be dark days ahead for the House of Mouse.

Comments