Tandem app to revolutionise banking in 2018

In 2017, the banks were never far from the headlines. Poor customer service, security breaches, money-laundering and cashpoint outages are familiar territory for customers of the top four UK banks (Barclays, HSBC, Lloyds and RBS), who continue to manage 77 per cent of UK current accounts. An over-reliance on brand name as opposed to improving customer services means that the majority of UK customers are simply getting what they expect from banks but not necessarily what they want. Tandem wants to change that.

There is a golden opportunity at stake for challenger banks…

Challengers of recent years such as Metro Bank and Virgin Money have made valid attempts to revitalise the market, with Metro Bank experiencing record customer growth and a 77 per cent increase in quarter-on-quarter profit at the end of last year. Metro Bank shares have also risen by 75 per cent since its interesting IPO offering in 2016, but are its services innovative enough to set the standard for the future of twenty-first century banking?

Within a world of the ‘Internet of Things’, on-demand digital disrupters such as Uber, Whatsapp and Airbnb have revolutionised the way we operate. I believe the banking sector should prepare for an equally massive hit, more impactful than the likes of Metro Bank, because there is a golden opportunity at stake for challenger banks. They would benefit from new systems that can quickly and easily be integrated with the newest mobile software, payment innovations, the use of blockchain and open APIs. A new way of banking could be built with the customer at its heart.

An ‘app-only’ bank undoubtedly appeals to millennials…

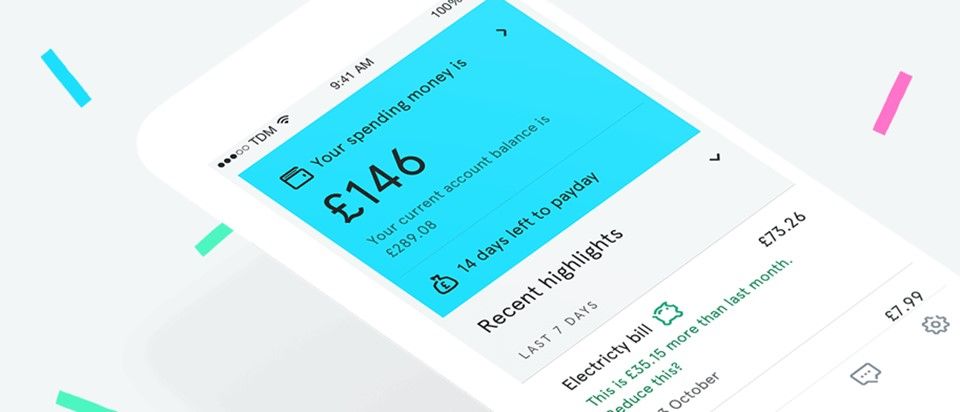

New start-up Tandem plans to hit the ground running in 2018, promising its customers faster and more personalised banking that exposes the inefficiencies of the ‘vanilla banking experience’. It provides insights into your spending through its app, designed to manage your outgoing bills and actively seek better deals to save you money. It is also now able to offer a selection of banking services, starting with a cashback credit card with no overseas fees, and two fixed term savings accounts (for which there is already 27,000 people on their waiting list). An ‘app-only’ bank undoubtedly appeals to millennials, but the security surrounding it is an obvious concern for those less comfortable with the technology. Yet, having acquired Harrods Bank in a deal adding £80m of capital and doubling Tandem’s customer base last December, the company has regained its banking license. This means that it is just as regulated as a bank on the high-street. It is also backed by the Financial Services Compensation Scheme, much like other banking apps like Atom, Starling or Monzo, which protects savers’ money of up to £85,000 should the bank go bust.

Simplification is the key to connecting with a modern market…

But what makes Tandem that much better than these other app-based banks, which have attracted millions of pounds of savers’ deposits? The answer lies in Tandem’s product offering; simple and effective banking services, integrated with a personalised financial management app. The company is also embracing new regulations and developments in product features that are expected to gain momentum in the fintech world. An example of such is PSD2 (Second Payment Services Directive) which came into force earlier this month, and requires banks to open up their payment infrastructure and release their data in a secure, standardised form to third parties. Tandem sees this as a way to introduce the public to open banking in a simplified manner and develop their own products and trust within that space.

It seems that simplification is the key to connecting with a modern market, particularly within the financial sector where the ‘best deal’ can seem hard to find despite the popularity and draw of comparison websites. The unification and integration of Tandem’s offering, as well as the effective use of customer’s individual data results in not only a banking solution, but a personalised life solution that has the potential to change the way we think about spending our cash. 2018 is set to be a great year for Tandem, with CEO Ricky Knox confirming talks with former Barclays chief Bob Diamond about taking a possible stake. Watch this space.

For more information on Tandem, visit their webpage here.

And see The Boar’s own guide on student banking.

Comments (1)