Why we should embrace ‘sin taxes’

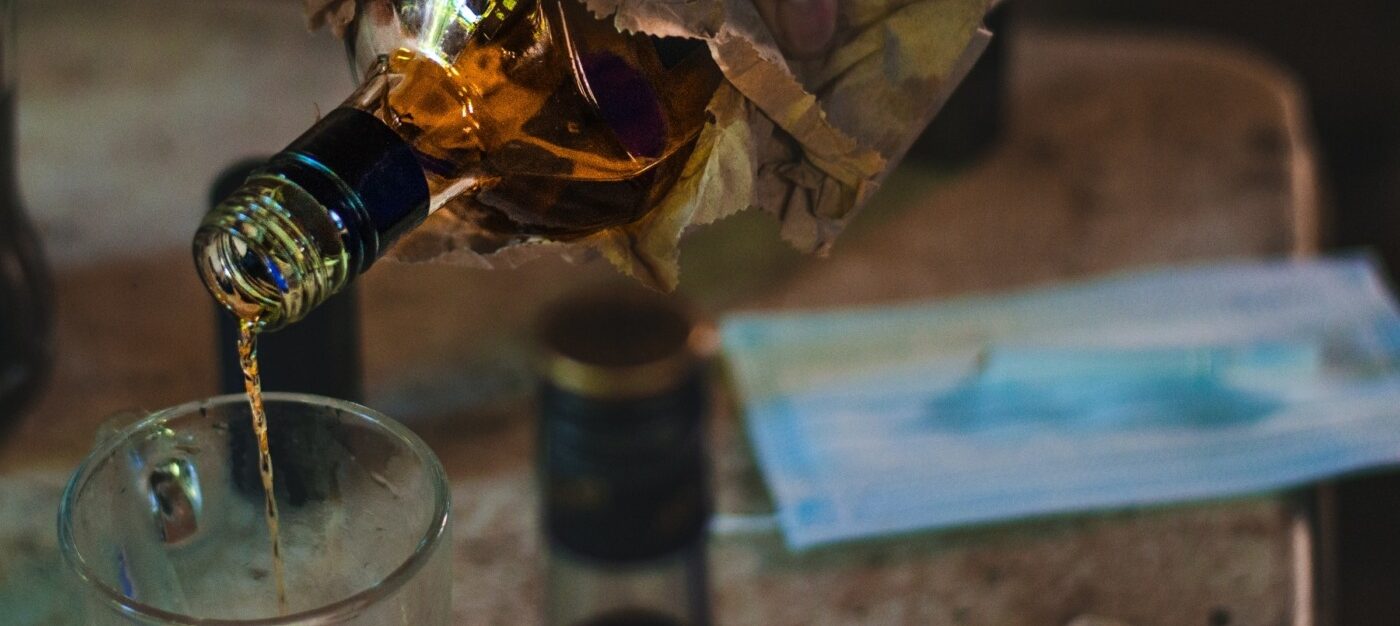

If I had to come up with the least popular policy imaginable, ‘higher pint prices’ seems like a pretty good attempt. Especially in student politics, hiking booze prices seems like career suicide. Like it or not, however, it is a good policy, and the Scottish and Welsh governments have both introduced it.

The Scottish Government introduced a Minimum Unit Price (MUP) on alcohol first, in May 2018. Regardless of what kind of alcohol you’re buying the price for a single unit could not dip below 50p. Decried as the ‘nanny state’ by some, we now have had adequate time since the policy was implemented to assess its effects.

Such a result is the worst of both worlds – regressive and ineffective

The results, as with most public policy, are mixed. A study in the Lancet journal found purchases of alcohol declined for essentially all groups, with the impact being most pronounced on those who buy the most alcohol. A Minimum Unit Price is designed to do this – compared to a flat tax on alcohol, it has an impact only on cheap forms of alcohol. As such, the Government can target ‘problem drinkers’ without necessarily hitting the average punter in their pocket.

However, the study also found that the impact on habits was small for a group of high-consuming but low-income households. For this group, the minimum price increased expenditure but did not really affect their consumption. Such a result is the worst of both worlds – regressive and ineffective.

In the light of these findings, should we embrace ‘sin taxes’? To address that first, we must ask: What is a sin tax for?

A ‘sin tax’ – a phrase seen frequently in the media – is a tax that seeks to discourage you from harming yourself. I don’t agree with sin taxes. I’m a liberal; if something harms only you, it should be your choice as to whether to do it. If you think someone‘s behaviour is against their own best interest, you’re well within your rights to try to persuade them, but it’s not the role of the government to intervene. As a result, the government does not have remit to tax people because their consumption of alcohol, or indeed other ‘vices’, are harmful to themselves.

Most measures branded a sin tax, however, are nothing of the sort, but are instead externality prices. That is, a tax that seeks to redress the cost to society of antisocial behaviour. It’s better to think of these more as a fine than a tax. In the case of minimum unit alcohol pricing, the purpose of the measure is to reduce the consumption of alcohol to a level that takes into account the cost to society, such as acute healthcare, violence, and long-term disease from alcohol consumption. This isn’t supposed to be punitive and moralistic – the point is not that no one should consume alcohol or that alcohol is sinful. Rather, it’s just to guide people to the amount of alcohol that’s best for society as a collective. In the case of the MUP, it’s also not even a tax. The state doesn’t gain additional revenue (beyond the VAT charged on the minimum price), they just dissuade people from buying alcohol.

It may be politically precarious in the short run, but we need to address the issues brewing as a result of binge drinking and alcoholism

Measures other than taxation can often be justified for the protection of the an individual’s wellbeing. The use of ‘behavioural nudges’, as developed by Richard Thaler and Cass Sunstein, are an effective and morally just form of ‘libertarian paternalism.’ They guide us to what experts believe is the best choice for us but always give us the option to pick something else. If we know better than experts for ourselves, we can choose differently. Similarly, bans on advertising harmful goods, which were implemented for cigarettes and are now being discussed for fast food and alcohol, make a lot of sense. No one is stopping you watching marketing material for booze – feel free to search them on YouTube – but in the absence of an active decision, it probably makes sense that we default to not seeing them.

When it comes to a tax, or a minimum price, though, reduction in harm to others is the only justified cause of an impingement on someone’s freedom. Why make a simple pleasure less affordable if it doesn’t hurt anyone else?

The fact, however, is that alcohol does hurt other people. When we drink, especially to excess, we do some small damage to everyone else that isn’t accounted for in our purchase. Admittedly, it’s only a small amount, and clearly, alcohol shouldn’t be banned outright. Instead, it’s right that we pay a small tax to offset this wrong, to finance the NHS, and clean up our streets after nights out. A Minimum Unit Price, therefore, is an improvement on no policy, but it’s inferior to a tax. After all, the profit goes to sellers of alcohol, not to the government. It also affects only the cheapest alcohol, which is often bought by the poorest people.

It’s time for a more profound intervention into the alcohol market by the UK Government. It may be politically precarious in the short run, but we need to address the issues brewing as a result of binge drinking and alcoholism. A tax is one small part of this, raising money to fund other measures and reducing consumption of alcohol overall. A Minimum Unit Price is not the way forward, and shouldn’t be imitated by the Westminster government. However, it is a start. When it comes to alcohol policy, as with much else, the SNP are doing a bad job, but the Tories are doing even worse.

Comments