The monetary policies by Bank of Japan, to go or not to go?

On the noon of 29th January 2016, the Bank of Japan (BOJ) surprised the world by cutting their deposit rate on commercial banks’ excess reserve into -0.1%. This makes the BOJ the first central bank outside Europe to introduce a negative interest rate policy.

In theory, a reasonable and stable inflation is a critical support to economic growth, whereas Japan suffered from deflation, i.e. negative inflation, for four consecutive years since 2009. In 2014, partially benefiting from “Abenomics”, inflation achieved to 2%, but again, dropped down to around 0% by the end of 2015, due to significant recession in China and other emerging economies, and also a sharp fall in commodity prices. As of August 2016, the inflation rate is -0.5%, showing that BOJ has a long way to go to meet its target.

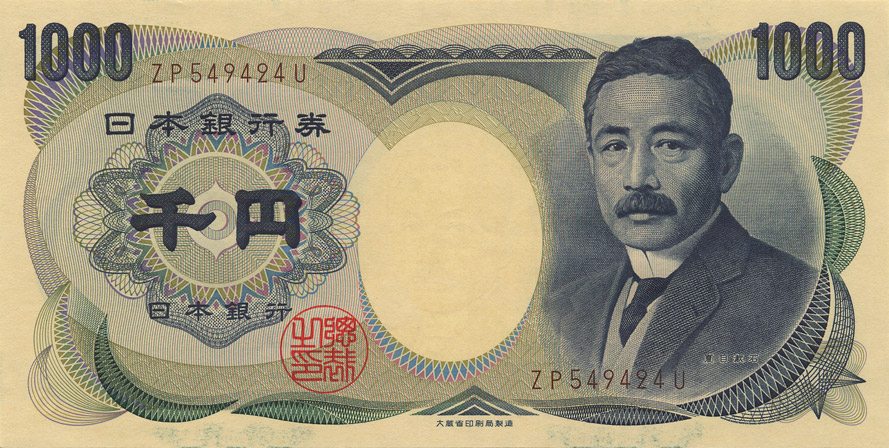

Basically, BOJ aims to increase the money supply by constantly and largely purchasing JGB and other bonds, to devalue its currency internally and externally, achieving both the inflationary target and depreciating Yen. Compare to those previous money-printing policies, the negative interest rate policy particularly and directly affected interest rate available on the market.

Straight after the policy being introduced, the interest rate on term deposit and loans slumped to a new low level, which will firstly discourage savings again (noticeably the interest rate on short-term savings in Japan has been constantly around 0% since the millennium), meanwhile boost consumption and possibly portfolio investment.

In particular, facing an expanding portfolio investment under the negative interest rate scenario, corporates are reforming themselves to be more attractive to cash holders who wants to invest.

However, the negative interest rate is such a huge cost to financial service sector in Japan. Paying a recognisable fee to BOJ has weakened banks and financial institutions performance. In addition, offering a cheap loan to the customer also decreases their interest earnings.

“Going forward, if judged necessary.” said Kuroda, the Governor of BOJ, on 29th January 2016. Yet nothing had been changed on the interest rate so far. With Japan backing to deflation, and strong Yen on forex market, 31st October, the next meeting of BOJ, may be the time to cut the interest rate to further area, but the negative impact on banking would be a massive trade-off.

Comments