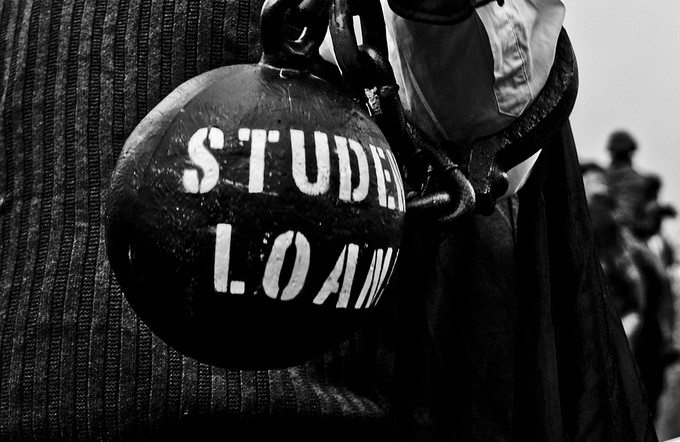

Student loan repayments are overestimated

The government is overestimating the amount of student loans that will be paid back, according to a committee of MPs.

The Public Accounts Committee (PAC) reported that there is £46 billion of outstanding student debt on the government books currently and this figure expected to reach £200 billion by 2042.

The government currently assumes that 35 to 40 percent of that debt will never be paid back. Even this figure is overly optimistic according to the PAC’s report.

Committee chairwoman Margaret Hodge stated the government frequently overestimated the amount of money it would receive from loan repayments by 8 percent.

“That is some £16bn to £18bn on the current debt of £46bn, and £70bn to £80bn on the estimated value of student loans by 2042” she said.

“But we don’t have confidence in those figures. We think that the value of student loans never to be repaid could be even higher.”

The PAC explained that these high percentages may be due to the fact there has been “no reliable model for forecasting how much will be repaid to the Exchequer” since the introduction of student loans in 1990.

The Department for Business, Innovation and Skills, operated by the Student Loans Company and HM Revenue & Customs, is responsible for the overall system of collecting repayments lies with.

The report suggested that the department should publish “clear and easily understood annual forecasts of what it expects to collect in the year ahead, and explain any subsequent variances between forecasts and the amounts actually collected.”

The committee also said that the method of collecting repayments is not tough enough. It claimed that the Student Loans Company does not make enough effort to find those who should be making repayments.

Ms Hodge said: “It knows very little about British graduates who live abroad or about graduates from the EU who have since left the country. Will they ever pay back their loans? The Student Loans Company simply doesn’t know.”

The Department for Business, Innovation and Skills argued it had “an effective and efficient process for collecting student loans through the tax system.” A spokesman said this resulted in “high collection rates at a low cost which we believe demonstrates good value for money”.

This said, the department did not deny that there is “room for improvement”, it understood the need to ensure everyone earning over the repayment threshold is paying their loans back, including those who have moved overseas since their course ended.

They are improving their collection process all the time and also “a new and more accurate forecasting system is being developed”, according to a committee spokesman.

While there are attempts being made to better the system, Rachel Wenstone, vice-president of the National Union of Students highlighted why the government have made such a huge mistake.

She explained: “Forcing debt on to students as a way of paying for universities is an experiment that has well and truly failed. We now need to see serious thought about moving the system away from this unsustainable funding burden.

“Graduates now stand to pay back twice, through their student loan repayments and as taxpayers confronting the spiralling costs of this ill-considered scheme.”

Sally Hunt from the UCU added that the government had rushed through the establishment of a loan repayment system “without doing the proper maths”.

She said: “We may well end up with the taxpayer footing a larger bill for students’ education than before students had to pay £9,000 a year fees. It is time for a rethink.”

Shadow universities minister, Liam Byrne described the student loans system as “unsustainable” and said it was likely to go “bust”.

This is because “universities are sitting on flimsy foundations,” he clarified, “we now need urgent answers from the government for how they’re going to fix this £80bn mess which our country cannot afford. Ministers have serious questions to answer.”

Warwick students agreed that the current system of loan repayments needed improving.

Laura Primiceri, first-year Literature undergraduate, commented: “I think the way we are currently expected to pay back student loans is unsustainable and scary. The threshold for paying back loans is too low when the cost of living is rising more rapidly than average.

I think these findings exemplify the fact that the government should not have increased the fees at all, and worked harder to find a different solution.”

Neil M, first-year Chemistry student, added “I think the way the loans are going to be paid back seems fair on graduates, but a better track should definitely be kept of those who owe money.

With the economic state the UK is currently in, they definitely didn’t think through the numbers when it comes to the amount of money they’re lending out. Raising tuition fees is one thing, but what’s the point if it’s only coming out of their own pocket? It’s going to have to be made up for somewhere along the line.”

Comments (2)

did you need an urgent business loan,contact bonkeyfred@gmail.com