Can’t put a price on that!

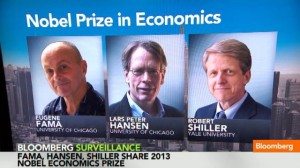

During the recent 2009 financial crisis, economists had faced widespread criticism of their failure in trying to predict and consequently avoid the global credit crunch. However, last week, the Nobel Prize committee addressed this by awarding the coveted associated award for Economics to Eugene Fama and Lars Peter Hansen of the University of Chicago and Robert Shiller of Yale for their pioneering work in the operations of financial markets, asset prices and behavioral economics.

Fama, Shiller and Hanson have all researched separately on the topic of financial asset pricing, and thus, predictability. Fama, the senior member of the trio started this work of the theory of efficient markets, finding that, when markets work well, asset prices reflect all the latest information. Thus attempts to profit by picking stocks were often fruitless.

However, two decades later Robert Shiller continued the work by finding that market efficiency was less enduring over time. Instead, he found that asset prices appeared to be much too volatile to be justified by fundamental information such as dividends.

Lastly, Hanson confirmed Shiller’s preliminary findings on bubbles as he developed a statistical theory called generalized method of moment to test whether the historical share prices were consistent with the best known asset-pricing model at the time. He found the methods being used must be rejected because they failed to explain share movement. Therefore it was finally described as the “perfect balance” between Shiller’s inefficient market theory on one side, and Fama’s proposal of efficient markets on the other.

As quoted by the Nobel Prize committee

their research showed that while it is difficult to predict asset prices in the short term, prices can be predicted in broad terms over longer periods, such as three to five years.”

Finally, when looking forward, the work established now will create strong foundations for possible warwick economics enthusiasts to continue future research or even apply the knowledge in the future.

Comments