Sanjay Raja at WES: How crises are redefining the global economy

In Warwick Economics Summit’s first Presents Event of the year, Sanjay Raja, one of the top economic forecasters working as Chief UK Economist of Deutsche Bank, delivered his talk titled “Shockwaves and Shifts: Navigating the Past, Present and Future”.

Sanjay mainly focused on three of the largest and most impactful shocks in this “extraordinary century” and how they’ve transformed into shifts affecting our economy. He named the global financial crisis of 2008, Brexit, and the Covid-19 pandemic.

Global Financial Crisis

Sanjay reminisced about his time stepping into his first macroeconomics classroom at university, saying he “could tell something extraordinary was happening” through the professor’s eyes. His professors were clearly worried about something.

And that something was “one of the biggest falls in living standards”, with GDP falling by 5% in the USA alone. People’s wealth collapsed as the stock market lost over 50%, making their plans for retirement seem like a lost dream.

Furthermore, US and UK house prices fell dramatically, by 30% and 20-25% respectively.

Sanjay also shared his own experiences of the weak labour market in the aftermath. He applied to over 120 jobs and only received one final offer. His wife struggled even more, having to send over 250 applications to receive a job offer.

The financial crisis has had longstanding impacts on the UK that we are “still grappling with”. Productivity growth before the crash was approximately 2% per annum, which has since fallen to 0.4%. This dramatic fall has had devastating impacts on the UK economy, with wages stagnating.

In the Q&A, he was asked why the government is struggling to fix the UK’s productivity. He believes there are “lots of ingredients” and academics haven’t “uncovered the roots” to our productivity puzzle, meaning the government doesn’t have the direction to try and fix the issue.

Brexit

Sanjay also discussed Brexit, which he described as the “biggest unilateral trade shock ever,” except for recent trade wars and tariffs propagated by Trump. He discussed how economists predicted it to cause anywhere between a 2% and a 10% reduction in GDP. There was a significant gap, as it was like “throwing darts in the dark” due to the unprecedented nature of the event.

Brexit has likely reduced UK GDP by approximately 5% according to research papers, with Sanjay arguing that it has been difficult to accurately calculate the effects of Brexit when we’ve had other large economic shocks like the Ukraine War, Covid-19 and Trump’s recent trade war.

Covid-19

The pandemic, as we know it, originally started with most people being sent home for only two weeks, only for it to end up being a year and a half until normal life continued. In April 2020, Deutsche Bank and Sanjay predicted the UK’s GDP would likely fall by 6%, with other forecasters predicting a 3-5% fall.

He claimed that not many predicted it would be above 10% and joked that most forecasters believed those who believed so were “on something”. However, even the pessimists were far off, with there being a 25% fall in GDP.

Sanjay claims the “pandemic forced economists to really think about how we measure growth”, with the pandemic having “blown the orthodoxy out the water”. Economists used to mainly focus on the labour market, inflation data, retail sales, and other more mainstream indicators of future growth. The pandemic changed this, with more variables being analysed, including traffic levels and CO2 emissions.

Furthermore, Sanjay mentioned the increasing trend of using machine learning models for forecasting, rather than purely econometric models. Deutsche Bank moved to machine learning models in 2018-19.

Looking to the future

Having explored three major crises in the 21st century, Sanjay turned to the major shifts that they set in motion, which “keep him up at night”.

The first one he described was the trade war and how “globalisation has come to an end”. He believes that the “political economy has never been so important as now”.

One of the most significant shifts he described was rising debt and fiscal risk. The financial crisis and the pandemic pushed debt levels to new post-war highs. UK debt is approximately 100% of GDP, and Japan’s is over 200%.

He claimed there is a “glut of borrowing” due to these economic shocks and big defence spending. Fiscal policy is going to “dominate for the next ten to twenty years”, with debt markets being the “arbiters of policy”.

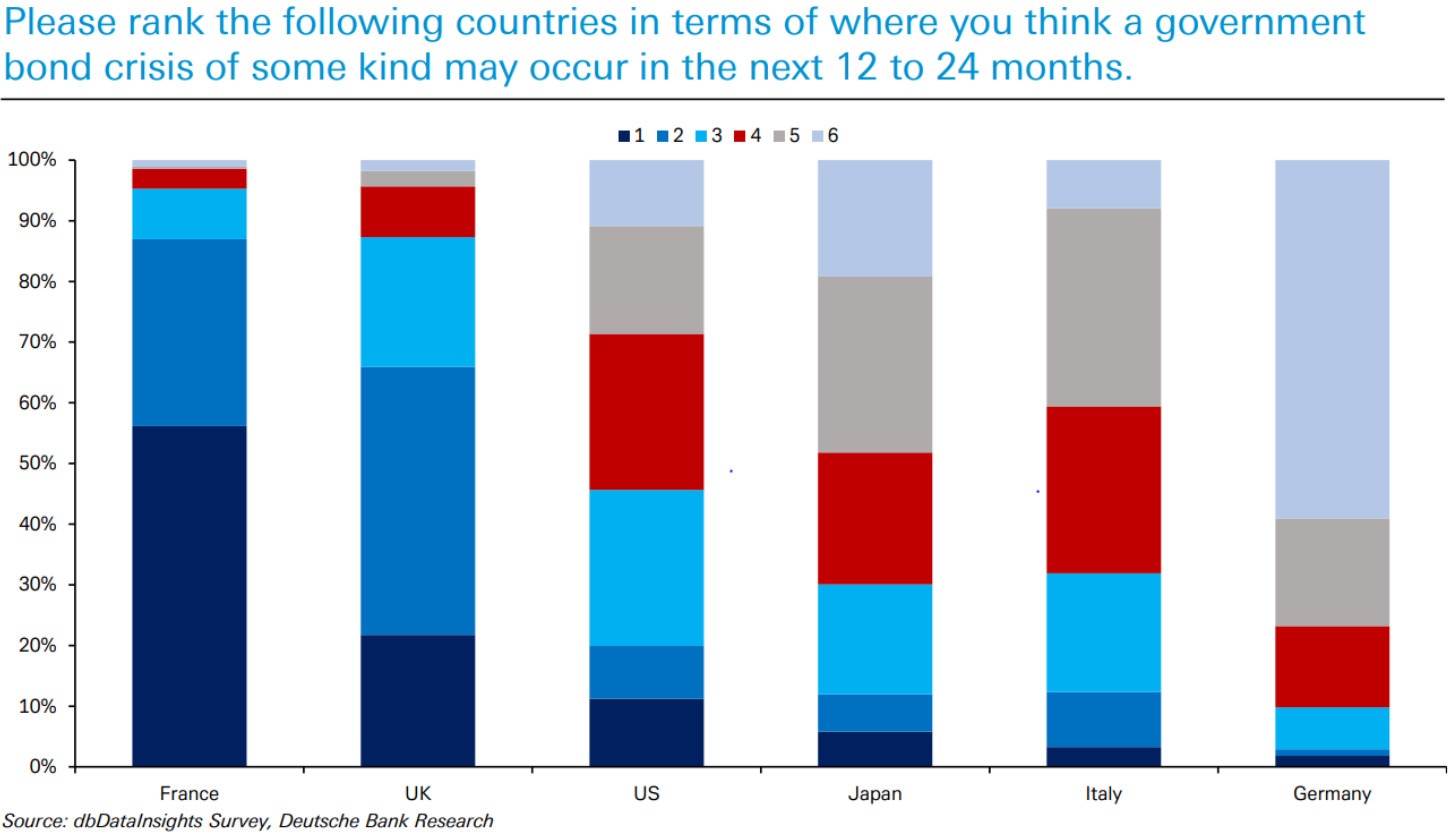

This was depicted through a survey conducted between September 22nd and 25th, where Deutsche Bank found that the majority of respondents believed France would be the most likely to suffer a government bond crisis in the next 12 to 24 months. The respondents mostly consisted of insurance, pension, and sovereign funds. France had a budget deficit of 5.8% in 2024 and is struggling to close it due to their political crisis, where prime ministers are consistently resigning. France’s 10-year yield has increased from 2.91% in December 2024 to 3.54% at the start of October 2025, signifying a large increase in borrowing costs. Worryingly, the UK is ranked 2nd in the survey, with about 20% of respondents believing the UK would be the first to suffer a government bond crisis.

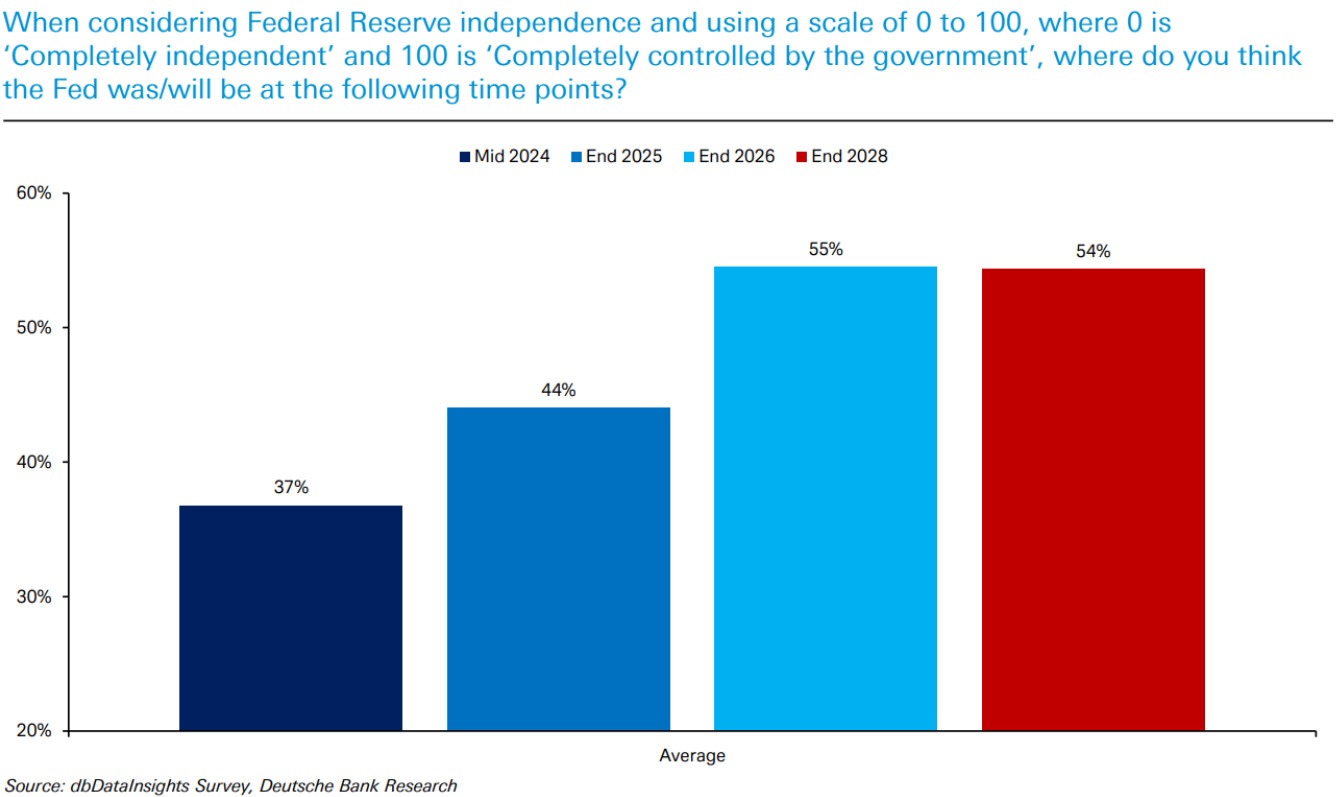

Furthermore, he is worried about central banks’ independence, something he believes is “super important”. If large organisations and the population start to question their independence, a viewpoint which is increasing in popularity as shown by the bar chart below, the “entire bond and equity market will falter”. This pessimistic viewpoint is likely caused by Trump’s increasing political pressure on the Fed to cut interest rates.

Earlier in the talk, Sanjay mentioned quantitative easing (QE), where he claimed that central banks are “scarred by the phrase” and unlikely to use it again.

In the Meet the Speaker session, The Boar asked whether quantitative easing was more harmful than beneficial after the financial crisis in 2008. Sanjay said it “had its moment” and was used in the “spirit of innovation”. He also claimed it could’ve stimulated economic growth, but he said QE was used for “too long” and didn’t consider asset prices or productivity.

He also says it’s had a long-term impact on the UK economy with the BoE now “selling down”, which is seeing “taxpayer money out the door” and “hurting public finances”. However, there is still a place for ‘financial stability purchases’. An example of this could be after Liz Truss’s 2022 Mini Budget, where the BoE bought long-dated gilts to prevent a financial meltdown rather than to stimulate the economy.

Comments