In the Interest of everyone?

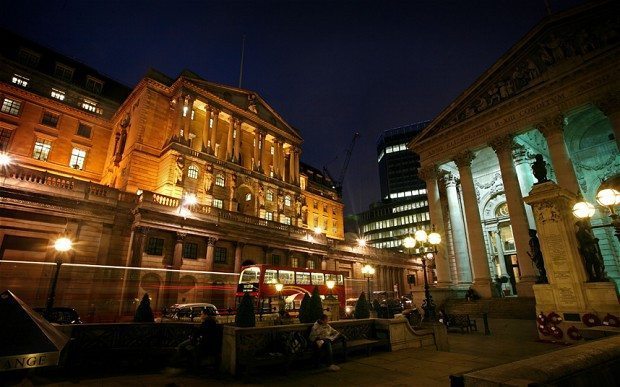

Back in August of this year, the Bank of England (BoE) adopted forward guidance into its monetary policy framework. The guidance stated that the BoE would not raise interest rates above 0.5% at least until unemployment falls below 7%. This guidance is subject to three clauses. Firstly, that forecast inflation in 18-24 months is no higher than 2.5%. Secondly, that inflation expectations remain anchored; and finally, that the financial policy committee judges do not believe that monetary policy is creating financial stability risks.

MPC forecasts project this improvement in employment to be achieved by around mid 2016. However, breaching the unemployment threshold will not automatically trigger a rate rise: The “at least” in the guidance statement is important. 7% is a “way station”. That is similar to the Fed’s policy. Guidance is that it allows the BoE to test the ability of the economy to recover some of the ground lost during the recession. If it turns out that productivity does rise quickly as growth returns, the unemployment threshold will not be hit for years and the BoE will keep the pedal to the metal.

If productivity does not respond and it turns out that much of the output lost since the crisis is gone forever, then the BoE will have to raise rates sooner. Since forward guidance has been introduced, unemployment has fallen more rapidly that the BoE had forecast. This has left investors uncertain about the course of action the MPC will take.

Despite repeated attempts by the MPC to give more clarity, it is clear that the policy may not be having the desired effect. Despite the marked increase in consumer and business sentiment, data shows that slightly fewer people now expect a rate rise in the next two years than they did back in July. There was more unwelcome news for the MPC this week as rising UK energy prices have caused a surge in the public’s inflation expectations.

It is still early days for forward guidance but there does appear to be an underlying sentiment that the BoE may be losing credibility among financial market participants. Since forward guidance is now tied to unemployment it makes forecasting dates even harder than it usually is. Market consensus now seems to expect the BoE to bring forward to Q1 2016, the date at which it expects to reach 7% unemployment when it next publishes forecasts.

Despite the marked increase in consumer and business sentiment, data shows that slightly fewer people now expect a rate rise in the next two years than they did back in July.

A rate rise is probably still two years off, however. UK output is still more than 3% lower than in 2007, there is widespread underemployment, and this consumer-led recovery will be solid rather than spectacular as long as real wages are still falling.

BoE guidance has been an overly complicated way of making a small change. With nine members explaining it differently, the message is not clear, reminiscent of the early problems with QE. It seems the message to take away is that the BoE is trying to say that it is focused on supporting the economy and is not worried about inflation a little above target. They might have been better off saying that, rather than tying themselves to a target.

Comments